SOSV announced the close of its $306 million SOSV V fund, the firm’s largest fund to date. The news received coverage in TechCrunch, Bloomberg and Axios. The text below is from the press release SOSV issued on April 16th concerning the new fund.

SOSV V will focus on deep tech startups in human and planetary health, with an emphasis on the intertwined imperatives of decarbonization and re-industrialization—part of the fund’s mandate to “reinvent the means of production”—even as SOSV continues to pioneer investments in health ranging from therapeutics to medical devices.

“As the first check in deep tech, SOSV represents the start of the journey for hundreds of deep tech founders,” said Sean O’Sullivan, SOSV’s founding and managing general partner. “We appreciate the dedication of many of the world’s leading family offices and corporations in backing SOSV V, enabling the creation of the most transformational climate change and human health startups on the planet. And, by partnering with later stage funds, every $100 million that we invest brings another $2 billion in follow-on capital into these companies. This new fund will enable an enormous amount of positive change for humanity.”

SOSV invests starting at pre-seed, when companies join its HAX and IndieBio development programs, and continues through series seed, A, and later stages, resulting in about 200 investments per year. SOSV operates startup program facilities in New York City, Newark, and San Francisco and graduates about 80 startups a year.

SOSV tracks top portfolio startups in its annual Climate Tech 100 and Human Health 100 lists, which include standout climate companies such as NotCo (AI platform to design plant-based foods); Prolific Machines (optogenetic biomanufacturing); Unspun (3D weaving technology to decarbonize fashion); Neptune Robotics (hull-cleaning robots to reduce maritime emissions); and Zymochem (bio-based materials to decarbonize everyday products), and health companies such as Ten63 (AI and physics-driven drug discovery platform); Prellis (3D-printed lymph nodes for drug discovery); and Flow Neuroscience (depression-treating headset).

The limited partners in SOSV V include corporates, sovereign wealth funds, institutional investors, and private family offices around the world.

SOSV’s HAX and IndieBio programs are widely recognized for launching startups that are primed for institutional, early stage investors. Active deep tech co-investors in SOSV portfolio companies welcomed the SOSV V news.

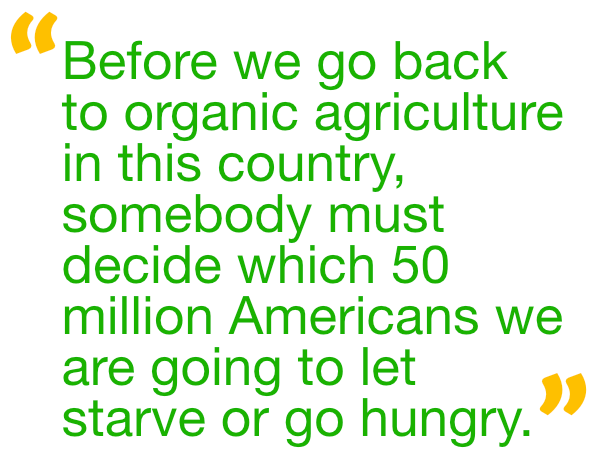

“The fight against climate-driven privation, societal disruption, and loss of life is an existential fight to preserve resilience and defend abundance for all,” said Matt Ocko and Zachary Bogue, DCVC co-founders and managing partners. “We partner with SOSV in their Decarbonization Consortium not only because they are fellow deep-tech investors, but also because they are determined like us to find every possible way to decarbonize without deprivation. SOSV V will bring power and expertise to this fight.”

“At Khosla Ventures, we often begin our work at Seed and Series A, partnering with great teams trying to solve big, important problems with unique, transformative technologies,” said Alex Morgan, partner at Khosla Ventures. “We really enjoy working with SOSV, including their HAX and IndieBio programs, and we’re pleased that SOSV has closed its Fund V. We have joined together to support several exciting companies addressing human health, climate, and food—including Opentrons, Flow Neuroscience, Prellis, Oobli, and Vertical Oceans—and expect to work on more in the future.”

SOSV has invested over $30 million in facilities and equipment to help deep tech founders develop and de-risk their technologies. In the past 18 months, SOSV has opened two new spaces—IndieBio New York at 7 Penn Plaza and HAX in Newark, NJ—with $25M in grants each from Empire State Development (ESD) and New Jersey Economic Development Authority (NJEDA), and also relocated and expanded the IndieBio San Francisco location.

Together, the new locations offer founders 80,000 square feet of working space equipped with BSL 1 & 2 wet labs, chemistry labs, mechanical and electrical engineering labs, machine shops, industrial grade 3D printers, and more. Eight Ph.Ds and numerous support staff, as well as offshore design, sourcing, and engineering teams in Pune and Shenzhen, work side-by-side with founders.

To address its climate and health mission, SOSV calls on the best minds around the world, and the portfolio displays diversity and achievement unrivaled in venture. The firm’s founders represent 75 nationalities and operate in 40 countries. 44% of its founders have PhDs earned at 70 universities around the world. And 33% of SOSV’s startups have at least one female founder.

One of the earliest founders SOSV backed is HAX alum Chiu Chau, co-founder of the unicorn Opentrons, a highly successful lab automation robotics company. He is now back at HAX with a new startup, OpenShelf, a robotic inventory system for healthcare. “Back in 2014, SOSV’s pre-seed check and HAX’s Shenzhen program were absolutely critical for me and my co-founders to launch Opentrons,” said Chiu. “I never dreamed that ten years later I’d be building my new robotics company at this new HAX office in Newark, but I would not want to be anywhere else.”